|

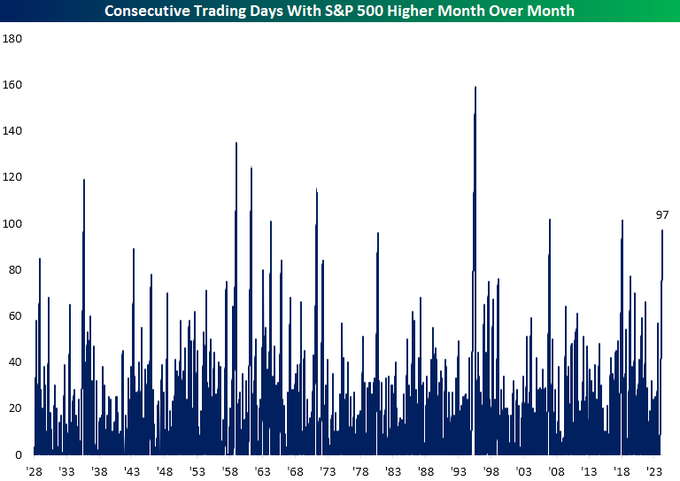

The S&P 500

has been positive on a month/month basis for 97 straight

trading days.

That's the 9th longest streak on record. |

|

00:01 -

05/04/24 |

|

|

| |

|

|

| |

|

|

| |

|

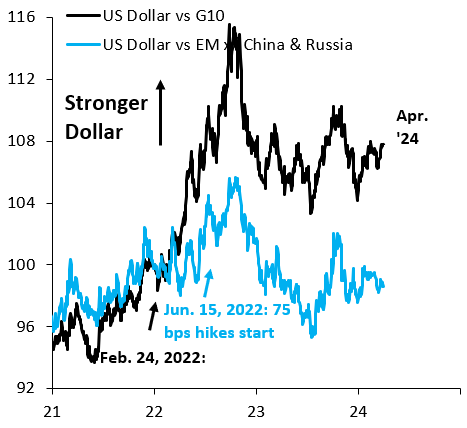

The Dollar is up 4% so far in 2024. That's mostly vs the G10

(black), driven by rate differentials as high inflation

causes markets to dial back Fed rate cuts. That catalyst for

USD strength is now played out. Next catalyst is the US

election and tariffs on China and Mexico... |

| |

|

|

| |

|

|

| |

|

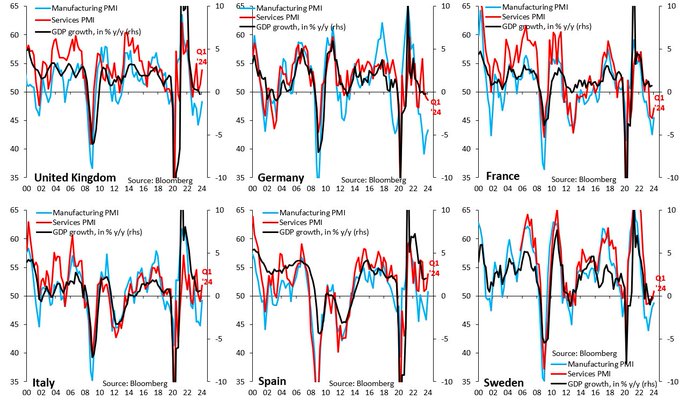

Weakness in Europe radiates out from two countries: Germany

(top middle) where it is manufacturing that is still very

weak in Q1 2024 (blue) and France where services are much

weaker than anywhere else (red) |

| |

|

|

| |

|

|

| |

|

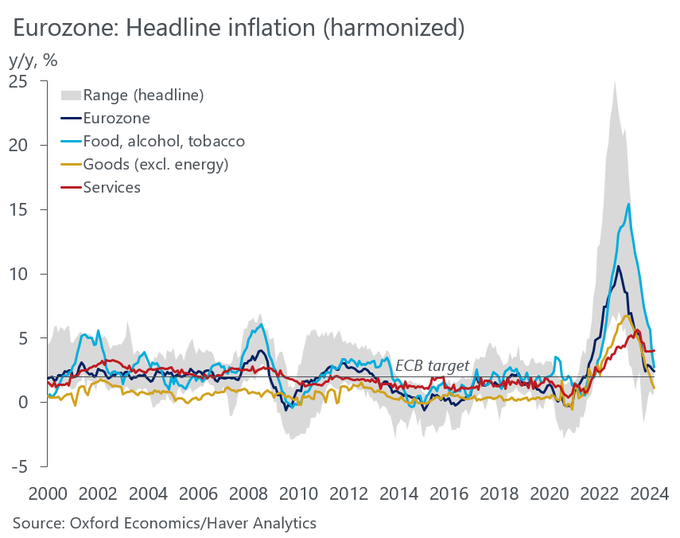

As expected, Eurozone headline inflation dropped to 2.4% in

March, while dispersion among member states narrowed. |

| |

|

|

| |

|

|

| |

|

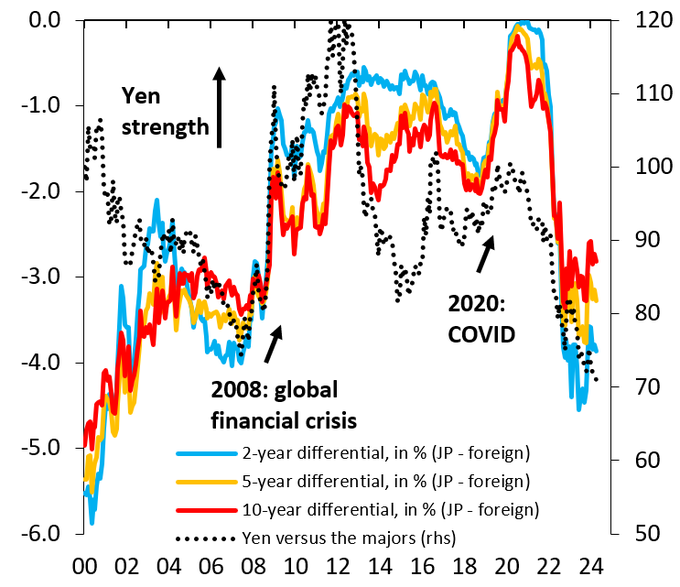

Japan's Yen weakness is a sign of fiscal crisis. High debt

means BoJ has to cap yields, while rates everywhere else are

up lots since COVID. That means rate differentials have

moved massively against the Yen. You can cap yields for

fiscal solvency. But then your currency falls... |

| |

|

|

| |

|

|

| |

|

|