|

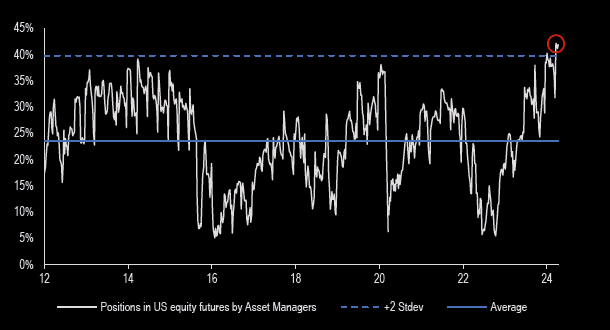

Asset managers remain very, very long this market, says JP

Morgan. |

|

00:01 -

30/04/24 |

|

|

| |

|

|

| |

|

|

| |

|

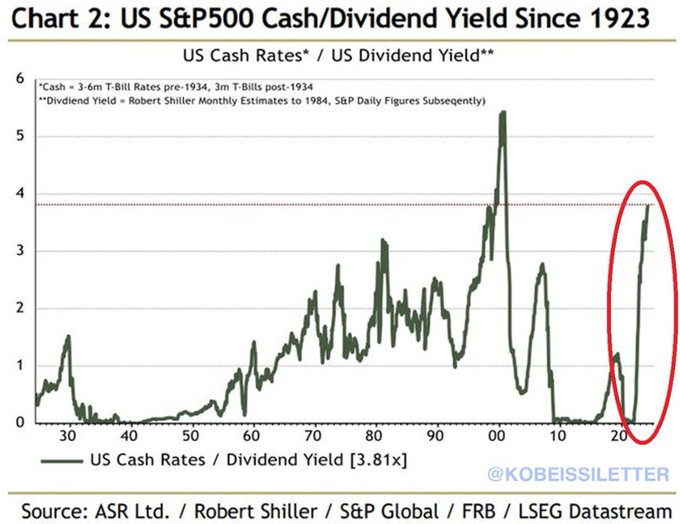

To put things into perspective: In the US,

the risk-free yield is now higher than the risky stock

market yield. 10y US yields have jumped to 4.62 this week

while S&P 500 earnings yield (1/PE ratio) trades at 4.21%. |

| |

|

|

| |

|

|

| |

|

Treasury Bills

BIL

are yielding 381% more than the S&P 500

SPY

dividend. The large spread between cash & stock yields is

similar to what was seen during the Dot-com bubble, a period

of high stock market valuations. It's uncommon to see a

spread this high over the past century |

| |

|

|

| |

|

|

| |

|

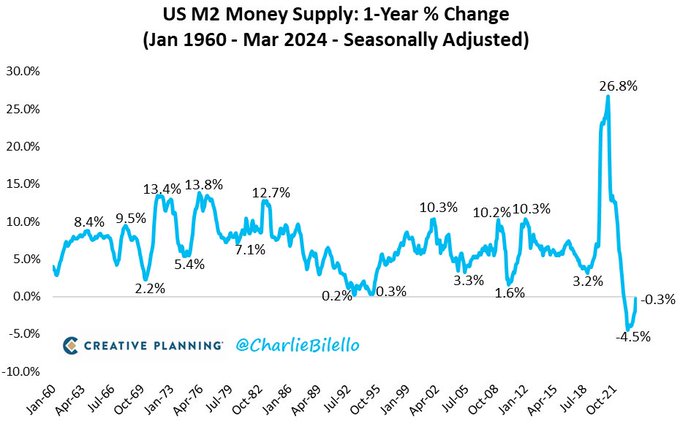

The

US Money Supply fell 0.3% over the last year, a record 16th

consecutive month with a YoY decline.

But this is the smallest YoY decline we've seen in the last

16 months and it looks likely to turn positive again next

month. The return of money printing? |

| |

|

|

| |

|

|

| |

|

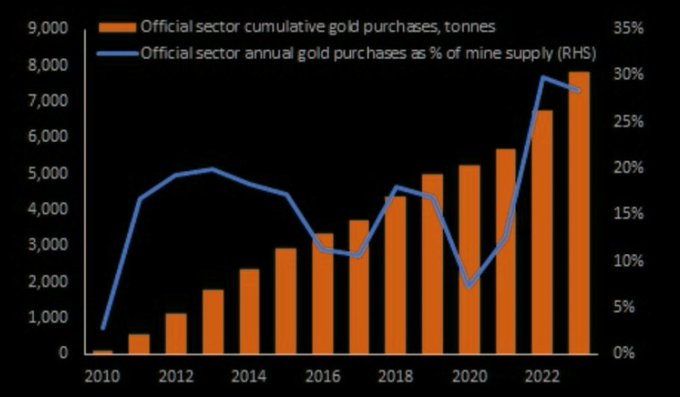

Gold purchases by central banks are helping to keep prices

supported, as they are now close to a record amount of

purchases vs mine supply |

| |

|

|

| |

|

|

| |

|

|